As we step into 2025, the real estate landscape is brimming with opportunities for savvy investors. Whether you’re eyeing Singapore’s vibrant market or exploring global trends, this year promises to be pivotal.

Here are the key highlights:

- Singapore’s Market Growth: Private property prices are projected to rise by 4-7% in 2025.

- Global Real Estate Recovery: The market is expected to see a gradual recovery with increased transaction volumes.

- Emerging Trends: Sustainability and digital transformation are shaping investment decisions.

- Investment Hotspots: Vacation destinations and logistics sectors are gaining traction.

The real estate market is always a mix of challenges and opportunities. In 2025, investors will need to stay sharp to navigate the changing landscape. From rising interest rates to shifting consumer preferences, understanding these dynamics is crucial for making informed decisions.

Singapore: A Hub for Real Estate Investment

Singapore’s real estate market is buzzing with excitement in 2025. Falling interest rates, coupled with a stable economy and an influx of new developments, create a rare window of opportunity for investors. Here are some key factors driving the market:

- Interest Rates: Mortgage rates are projected to remain at multi-year lows, making property purchases more affordable.

- Supply Boom: Over 11,000 new launch condo units are entering the market, offering buyers a wide range of options.

- Sustainable Growth: Private property prices are forecasted to rise by 4-7%, reflecting strong but measured demand.

Singapore’s position as a financial hub, combined with its limited land availability, ensures consistent property appreciation.

This is particularly true for high-demand areas, such as those offering the cheapest freehold landed properties.

The government’s policies, including cooling measures, have helped maintain a balanced market, preventing overheating and ensuring sustainable growth.

For investors, Singapore offers a stable and transparent environment. The legal framework is robust, and property rights are well-protected, making it an attractive destination for both local and foreign investors.

In the heart of Singapore, The Continuum stands out as a groundbreaking development that seamlessly blends modern luxury with strategic sophistication.

Nestled in a prime location at Thiam Siew Avenue, this freehold condominium bridges two distinct lands into one harmonious oasis, offering an unparalleled lifestyle.

Whether you’re an astute investor or a discerning homeowner, The Continuum presents a promising opportunity in Singapore’s evolving real estate landscape.

Global Real Estate Trends

The global real estate market is poised for a gradual recovery in 2025, driven by several key trends:

- Cross-Border Investment: Geographic diversification strategies and the opportunity to acquire assets below prior-peak valuations are supporting cross-border investment.

- Sector Focus: Investors are prioritizing the industrial, logistics, and living sectors, with an emphasis on asset quality and income growth.

- Technological Advancements: Proptech and AI are transforming property valuations and transaction processes, making them more efficient and secure.

The recovery is also influenced by economic factors such as lower interest rates and improving investor sentiment. However, challenges like geopolitical tensions and supply chain disruptions remain. Investors must be cautious and adaptable to navigate these risks effectively.

In terms of sectors, the industrial and logistics sectors are seeing significant growth due to the rise of e-commerce and the need for efficient supply chains. The living sector, including residential and student housing, is also gaining traction as demand for quality living spaces increases.

Opportunities in Emerging Markets

Emerging markets offer exciting opportunities for real estate investors in 2025. Vacation hotspots are once again prime locations due to growing demand from holidaymakers and remote workers. The flexibility of work arrangements has led to increased interest in extended stays in desirable destinations, blending work and leisure.

For instance, areas with strong tourism potential are seeing renewed interest from both domestic and international buyers. Real estate agents and property managers are likely to experience heightened activity in these markets. The appeal of emerging markets lies in their potential for high returns, although they often come with higher risks.

Here are some key considerations for investing in emerging markets:

- Market Research: Understand local market dynamics and potential for growth.

- Risk Assessment: Evaluate the political and economic stability of the region.

- Diversification: Spread investments across different sectors to mitigate risks.

By focusing on these factors, investors can capitalize on the opportunities available in emerging markets while managing potential downsides.

Key Investment Strategies for 2025

To thrive in the real estate market this year, consider the following strategies:

- Diversification: Spread investments across different sectors and geographies to mitigate risks.

- Asset Quality: Focus on high-quality assets with strong income growth potential.

- Early Mover Advantage: Act early to capitalize on emerging trends before they become mainstream.

- Sustainability Focus: Invest in eco-friendly properties to enhance long-term value.

- Market Knowledge: Stay informed about local market trends and policy changes.

Understanding local market dynamics and government policies is crucial for making informed investment decisions. Investors should also keep an eye on technological advancements and how they impact the market.

In addition to these strategies, maintaining a long-term perspective is essential. Real estate investments often require patience, as returns can take time to materialize. By focusing on quality assets and staying adaptable, investors can navigate the complexities of the market effectively.

The Role of Technology in Real Estate

Technology is playing a significant role in shaping the real estate sector. Proptech is expected to drive new activity in the international property market, simplifying workflows and streamlining compliance.

Innovations like digital payments and blockchain technology are making transactions more secure and transparent.

The ongoing growth of AI will also impact property valuations, providing more accurate assessments and reducing the risk of overvaluation. This shift towards digital solutions is not only improving efficiency but also enhancing the overall investor experience.

Here are some ways technology is transforming real estate:

- Digital Platforms: Online platforms are making property searches and transactions easier.

- Data Analytics: AI-driven analytics are providing deeper insights into market trends and property values.

- Smart Buildings: Integration of smart technologies in buildings is enhancing user experience and efficiency.

By embracing these technological advancements, investors can stay ahead of the curve and capitalize on new opportunities.

Decarbonization and Sustainability

Decarbonization efforts are accelerating in the real estate sector, driven by rising energy costs and concerns over energy security. Investors are increasingly focusing on sustainable developments, which not only reduce environmental impact but also enhance property value.

Sustainability has become a cornerstone of Singapore’s real estate market, influencing buyer preferences and driving demand for eco-friendly properties. Developers are incorporating green features into their projects, from energy-efficient systems to green spaces, to appeal to environmentally conscious buyers.

Here are some benefits of sustainable investments:

- Enhanced Value: Eco-friendly properties tend to appreciate faster over time.

- Lower Operating Costs: Energy-efficient systems reduce utility bills.

- Compliance: Meeting sustainability standards can help avoid regulatory penalties.

By prioritizing sustainability, investors can not only contribute to a greener future but also enjoy financial benefits.

Market Risks and Challenges

Despite the optimism, several challenges remain in the real estate market. Supply shortages are expected to worsen for in-demand assets, intensifying competition. Geopolitical tensions and economic uncertainties can impact investor sentiment and market stability.

It’s crucial for investors to stay informed about these risks and adjust their strategies accordingly. Diversification and a long-term perspective can help mitigate some of these challenges.

Here are some strategies to manage risks:

- Stay Informed: Keep up-to-date with market trends and policy changes.

- Diversify: Spread investments across different sectors and geographies.

- Risk Assessment: Regularly evaluate potential risks and adjust strategies as needed.

By being proactive and adaptable, investors can navigate the complexities of the market effectively.

Global Real Estate Investment Trends

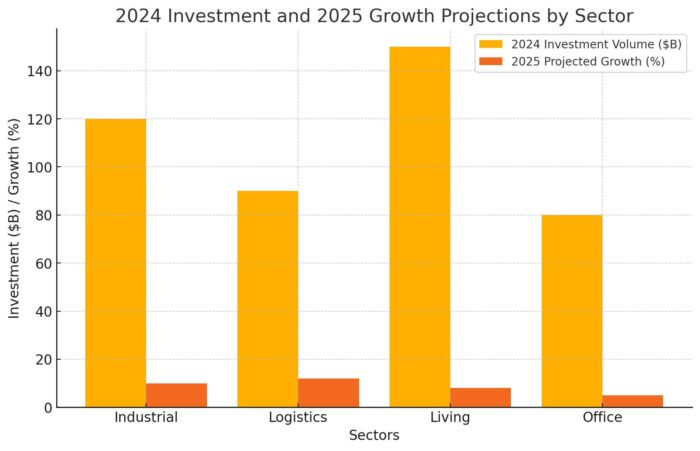

Here is the histogram chart displaying the 2024 investment volume alongside the 2025 projected growth for different real estate sectors.

The logistics sector stands out with the highest projected growth at 12%, driven by increasing demand for warehouse and distribution facilities due to the expansion of e-commerce and global supply chain networks. Investors looking for steady returns in asset-heavy industries should pay close attention to this trend.

Industrial properties follow closely, with a 10% projected growth, fueled by continued manufacturing expansion and shifts in production hubs across various regions. This sector remains resilient, supported by both local and international trade developments.

Living spaces are projected to grow by 8%, showing continued demand for residential investments. Factors such as urbanization, affordability concerns, and the rise of alternative housing solutions, such as co-living spaces, contribute to this steady increase.

The office sector, however, lags behind, with only a 5% expected growth. Remote work policies, shifting corporate real estate needs, and rising operational costs contribute to this slowdown. Investors considering office properties must be selective, targeting locations with strong long-term demand rather than speculative developments.

The histogram effectively highlights where capital is flowing in 2025 and provides a visual representation of which sectors hold the most potential for investors.

Those looking for high returns should focus on logistics and industrial spaces, while residential markets remain a stable, moderate-growth option. Office investments require careful evaluation, given the ongoing uncertainties in corporate real estate demand.

Conclusion

In conclusion, 2025 presents a complex yet promising landscape for real estate investors. Whether you’re investing in Singapore’s vibrant market or exploring global trends, understanding the nuances of the market is key to success. By focusing on emerging trends, technological advancements, and sustainable practices, investors can navigate the challenges and capitalize on the opportunities available in the real estate sector.