Starting in the financial market can feel like stepping into a maze. With countless platforms and options available, knowing where to begin seems overwhelming. That’s why having the right tools makes all the difference. New investors need simple, effective, and reliable solutions that make the experience less stressful and more profitable.

In this guide, we’ll explore some of the best options for new investors in 2024. Each option is tailored to help make your trading beginnings smoother, minimize confusion, and increase your chances of success.

Key Points:

- Tools to simplify investing decisions

- Platforms that prioritize ease of use

- Features that cater to beginners

1. Binomo – Start Small, Learn Smart

One of the first hurdles investors face is understanding the right platform to begin with. Binomo offers a simple entry point for new investors by letting you trade with minimal investment. Registering gives access to $10,000 in a demo account, allowing beginners to learn without the risk. There is no cap on the number of transactions, so users can explore various strategies with ease. Start trading at Binomo log in and get familiar with its offerings.

2. Robinhood – No Commission, No Hassle

Robinhood has become a popular choice for new investors because it eliminates commissions, making it an affordable option for everyone. It focuses on simplicity, offering a mobile-first platform that makes managing trades effortless. The app includes useful features such as instant deposits and the ability to trade stocks, options, and cryptocurrencies in one place. This makes it perfect for anyone just getting started.

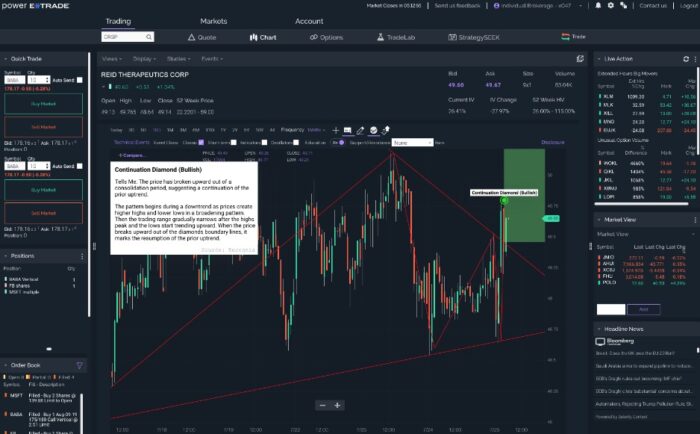

3. E*TRADE – Comprehensive Research for Confident Decisions

For those who want to dive deeper into data without feeling overwhelmed, ETRADE strikes a great balance. The platform offers a variety of investment options and integrates in-depth research tools. ETRADE provides valuable educational resources that can guide investors at every level, making it easier to develop the knowledge needed to trade with confidence. It’s a well-rounded option that supports both casual users and more serious ones alike.

4. TD Ameritrade – Exceptional for Education

TD Ameritrade stands out for its wide range of educational resources. Their platform not only offers tools to trade but also provides top-tier educational content for those eager to improve. Investors can attend live webcasts, access articles, or even use a paper trading account to practice strategies before committing real money. The ability to customize dashboards and tools allows for a more personal trading experience.

5. Webull – For the Data-Driven Investor

Webull is an excellent option for those who love data and analysis. The platform provides a wealth of advanced tools that can be particularly useful for technical traders. There are no commissions or fees for trades, making it appealing for cost-conscious investors. Additionally, it offers extended trading hours and access to real-time market data, perfect for those who want more control and visibility over their investments.

6. SoFi Invest – Integrated Finance and Investments

SoFi Invest is unique because it merges financial planning with investing. The platform allows users to manage their finances alongside their investments. It offers a streamlined interface with features like automated investing, fractional shares, and crypto trading. For those who prefer a more hands-off approach, SoFi’s automated tool offers personalized portfolios that can be adjusted to meet your financial goals.

7. Acorns – Investing with Spare Change

For someone who wants to start small, Acorns provides a creative approach to investing. It rounds up everyday purchases and invests the difference into a portfolio that matches your preferences. This passive approach is ideal for beginners who may not want to actively manage trades but still want to build wealth over time. The app requires very little effort and makes investing feel natural.

8. Merrill Edge – Bank-Integrated Investing

Merrill Edge allows users to connect their Bank of America accounts directly to their investment accounts, offering seamless money management. It provides a robust set of research tools and educational resources while also ensuring smooth transactions. New investors will appreciate how easy it is to track investments and manage personal banking in one place.

Conclusion

For anyone starting out in 2024, picking the right platform is crucial to having a smooth and successful investing experience. With various options available, each tailored to different needs, it’s essential to focus on what suits your specific situation to avoid unnecessary complexity or costs. Your investment journey should be supported by a platform that enhances your experience rather than complicates it.

The ideal choice depends on your preferences, financial goals, and comfort level with risk and management. Grow your portfolio confidently and efficiently, setting the foundation for long-term success!