Medical debt impacts the credit score negatively; this is quite a well-known and researched fact. This trend is set to continue for the unforeseeable future as the healthcare expenses have been on the rise keeping the parity with the burgeoning scientific developments. But, here-in lies the problem that this post deals with. A bad credit card is also a good option to take care of your finances. For more information on this, click here.

As medical expenses and healthcare bills rise, insurance organizations show the reluctance of covering the bills. Now, the fact about medical emergencies is that they never come announced and several crises are of the crippling kind, both economically as well as emotionally. Between doctor appointments, hospital visits and therapies, it is extremely difficult to maintain and manage medical bills. If truth be told a large number of the world population is currently living under what we call a “medical debt.”

Medical debt and credit score

Your credit score will take a hit the moment you are unable to clear your medical bills and in the process, end up accruing debt. Keep in mind that this hit is a substantial negative effect that will have ramifications if not dealt right at the onset. Hospitals, doctors and other emergency medical services are law-bound to report a debt or a failure to pay off to the credit bureaus and this, in turn, reflects in your annual score and report. Keep in mind that a single debt report will deduct around a hundred points off your credit score, and the report will reflect for a period of seven years.

A detailed picture

Let us start at the beginning. There are various credit scores, and all of them are influenced in some way or the other through medical debt. One of the primary credit scores is the FICO which will consider a small collection amount of any balance beyond $100. So, in case your medical bills aren’t small, you are in a world of trouble.

There are scores like the Vantage 4.0 that has severe penalties in case of medical dues since the medical collection is separate than the other collection accounts. Even with some newer varieties of credit score systems that tend to overlook the medical deficit, most of the traditional score formats will penalize you in the case of medical debt. This is why it is vital to make sure that you can maintain a high score.

About a bad credit card

The card mode of payment is one of the most widely used modes of making payments and offloading debts. And this is why the medical debt is all the more tied to the credit score. With credit cards, the initial confusion is about the lender choice. There are several options, and each comes with their own sets of pros and cons. And, if you have no clue about what to look for, then the search can get very tedious and very fast. A credit card like the first savings allows you to take out a line of credit even with a low personal score. However, what you need to pay as fee might be entirely dependent on the offer you receive, but keep in mind that a credit card option even with bad credit, in reality, is aimed at improving the credit score. For most of these services, including the First Savings credit card the annual fees, as well as the late fee, are quite low compared to the other premium service providers.

The advantages

If you are looking for the benefits of such a service, here are the notable ones.

For low credit scores

If you have a low credit score, you cannot apply for the big brands and the premier services. This is the main reason as to why these services are top-rated. So, if you are struggling with a low score and you are unable to apply, then this just might be the break you were looking for. There are several options in the market presently that operate sans hidden charges and don’t levy hefty fees. However, to use this to your advantage, you need to keep making the timely payments as it will allow you to better your score.

The use of mobile apps

Most of the credit card services come loaded with a safe and secure mobile network and app platform. This means that you can manage and check your account on the go. You can check your score and keep tabs right before making a purchase.

Building the credit score

As stated earlier, credit cards designed especially for low credit scores is beneficial for users since they can keep making the timely payments with lower interest rates which in turn will better the credit score in the long run.

Terms and conditions

Most of the inadequate services offer simple terms and conditions along with their policies. This makes the option a win-win scenario for most users.

Here are the top four factors that you need to consider before choosing a credit card with a bad score.

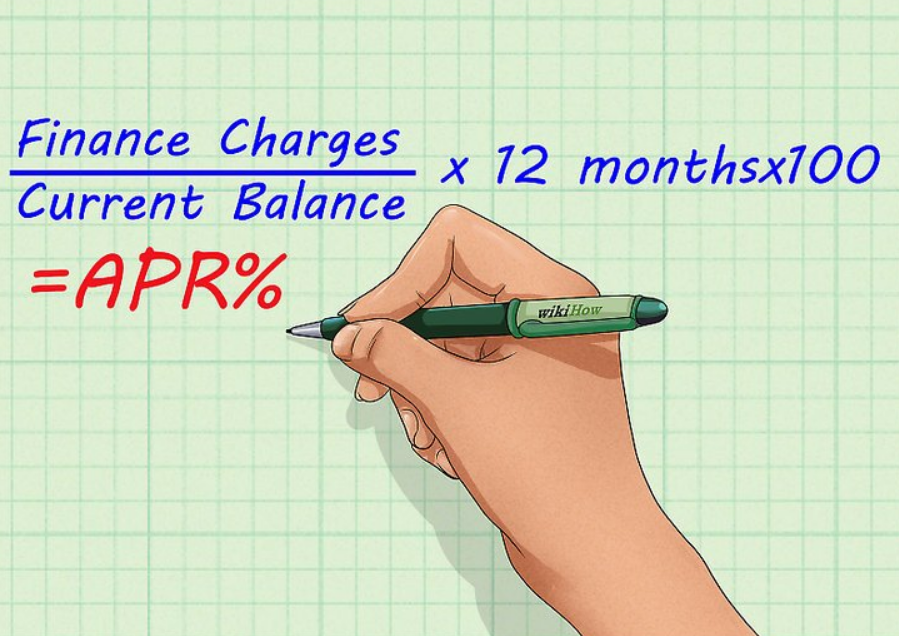

The APR

The APR can vary from 17% to 30%, roughly. This is why it is crucial to make timely payments and check the offers that fit you the best.

Various introductory offers

There are always several introductory offers whenever you sign-up for a new credit card. It all comes down to your personal preference, so read the offer document carefully.

Ease of acceptance

Credit cards that offer you benefits of loans with a poor credit score usually have the general acceptance norms that include the following.

- The individual has to be 18 years of age or older

- Document proofs that include the identity documents and SSN

- A legal resident of the United States

- Presence of a perceivable credit history

Acceptance rates of such services are quite high, and with the sheer number of benefits and perks to enjoy, it is quite a no-brainer to opt for it. This is especially true for individuals with a low and modest credit score. You can now build your credit score for a better report all the while taking care of the medical needs and emergencies. All the best!