One of the world’s fastest growing and most profitable commodity markets is Bitcoin. Since its start in 2009, it has only peaked in value and its market has attracted tons of investors from all across the globe. What started as a ‘fake currency’ with its value in cents is now one of the world’s most expensive commodities with a value of $60k per bitcoin.

Those who invested early in Bitcoin are well and happy and have billions of dollars in net worth right now. There are several people who wish to mimic their success and have invested in the bitcoin market inspired by them. Especially those who are investing in Bitcoin as of this month in July 2024, can get especially amazing returns when Bitcoin’s value rises again.

Investors use various sites like crypto-genisus.com/pl/login to invest in bitcoin and you can do the same. Investors have started realizing that Bitcoin is the upcoming commodity market right now, rather than gold, and investing in it is a wise decision. There have been many people who regret not investing in bitcoin in time. If you want to avoid that, you can click here to get started on your bitcoin investing journey.

There are various reasons why gold is not a relevant commodity market anymore and why investing in gold instead of bitcoin isn’t really a good decision. In this article, we’ll talk about the various reasons why Bitcoin is more valuable than gold. Read the article to the end so you don’t end up missing out on crucial details.

1. Bitcoin has more limited reserves than gold

When we call an object a commodity, it means that the said object has a finite supply of reserves in the entire world. Gold being a rare metal found deep within the earth, is a commodity and has an insanely large commodity market of its own. Bitcoin doesn’t have the same amount of value in the commodity market but it has a guarantee that gold doesn’t have – its extremely limited supply.

Bitcoin is not infinite and has a hard limit of 21 million bitcoins after which no more bitcoins can be mined. While gold has very limited reserves as well, pre-existing gold is in continuous circulation. We know for a fact that Bitcoin will run out of supply when it hits its hard limit but people are still unsure when gold will completely run out of its supply – it could run out in 100 years or it could run out in 1000 years, no one is too sure.

Also, when the earth’s gold supply does get depleted, it doesn’t necessarily mean that all gold supply has finished. Unlike Bitcoin, which exists only in computers and the digital framework with a limited supply, gold can be found beyond earth on other planets as well. Scientists have already found out that the moon is rich in mineral compounds and talks of “space mining” have become quite popular.

Thus, due to its very physical nature, gold is ironically in more supply than Bitcoin, which is digital in nature.

2. The growth trajectory of Bitcoin is exponential

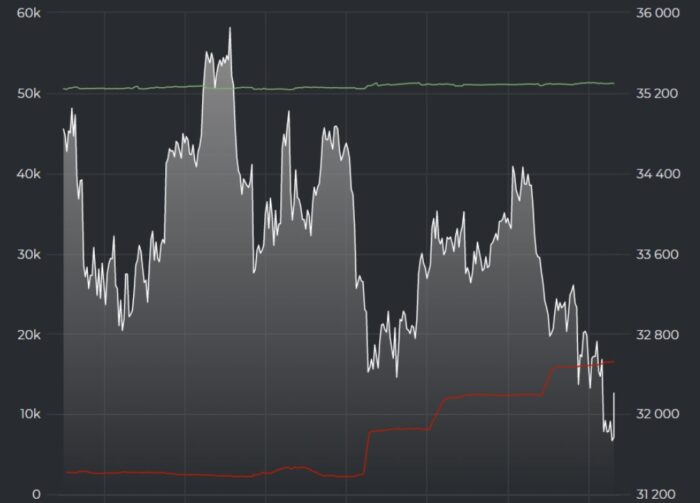

There are many investors who stay away from bitcoin claiming the market to be extremely volatile. However, it’s crucial to understand that this very volatility is what defines the cryptocurrency market and what makes Bitcoins so profitable. Bitcoin started out in cents ten years ago and recently this year it hit the $60k mark.

This growth has never been seen in any other market before, not even gold which was considered to be an extremely volatile market before bitcoin came. While it still is volatile, it doesn’t mean that it’s as volatile as Bitcoin, making Bitcoin’s growth rate something unique of its own. Bitcoin is famous for its growth trajectory, especially when one expects it the least.

If one invests right in Bitcoin at the perfect time, they can make quite an earning for themselves. The same can’t be said for gold. Even though it’s always rising and has occasional dips of its own, there is nothing too crazy about its growth rate making it a bad competitor to Bitcoin. Gold has always been the safe currency in which good long-term returns are guaranteed.

Bitcoin, on the other hand, has been the investment of the risky investor who is willing to risk considerable capital for immense returns. This has been the case for countless people who invested in bitcoin in its early stages and are now reaping the fruits of their wit and luck as “bitcoin billionaires”.

3. Bitcoin can be used in more versatile ways than gold

The biggest advantage of choosing Bitcoin over gold is that it can be used in multiple ways and is not limited by its constraints as a “commodity”. Bitcoin has become a completely valid form of payment in many stores and business organizations now. You can use Bitcoin to pay for items instead of using normal paper currency like dollars. However, this is impossible to do with gold.

You can’t take a bar of gold in a clothing store and tell the cashier that you would like to buy several clothes. The closest way of doing this is by either taking it to a bank or a jewelry store and exchanging your gold for its equivalent cash amount. The process is quite tedious, requires several documents in many cases and it is extremely dangerous to carry around a large physical amount of gold with you for, well, obvious security reasons.

Not only that but bitcoin can be easily exchanged with other cryptocurrencies or normal currency in a matter of a few seconds. This is simply not feasible to do with gold. Additionally, since Bitcoin is a digital currency, it can be protected in much better and secure ways. A prime example of this would be the hardware wallets Bitcoins have where all your bitcoin can be stored easily and in a secured way.

Due to these reasons, Bitcoin has several benefits over gold and is thus more financially viable and valuable to use.

Conclusion.

There are several reasons why bitcoin is more valuable than gold. We hope this article was insightful for you and if it was, please consider following our website for regular updates as it will help us out immensely.