The analysis of the crypto industry often ends already at the very beginning with the bright conclusion that all this is just a bubble. But even the question itself, cryptocurrency bubble or not, only obscure the topic. If you wish, you can make a bubble from anything: from stocks, real estate, even money. But none of them is, of course, a bubble.

In reasoning, you can try to start from the fact that in the cryptocurrency format, it was possible to create a completely intangible asset that is reliably protected from fakes and, under certain circumstances, can even serve as a treasure.

The Bitcoin and Financial System

For example, in the financial system of the digital economy, bitcoin may well take its place next to gold, because in their properties, they are almost identical. Bitcoin, like gold, is not enough, it is becoming more and more difficult to mine, and operations with it require serious costs. Its authenticity is easy to verify, and falsification is not economically feasible.

At the same time, bitcoin is deprived of the inherent logistical flaws in gold and can be instantly moved to anywhere in the world, which becomes critical at the speeds of the digital economy.

And over time, we can expect that, by analogy with real gold, the cost of bitcoin will be regulated by non-market methods, and its rate volatility will drop to a level acceptable for practical use in the economy. The result will be a decrease in volatility and other cryptocurrencies.

Bitcoin can also claim to be digital gold for historical reasons, like the first virtual currency. And in fact, he is also the guarantor of the entire crypto-financial system, because trust in it builds confidence in all other cryptocurrencies. And in the situation of their wide circulation, the discrediting of bitcoin can pose a real threat to the system as a whole.

Bitcoin Has Boosted the Trading & Investing Processes

If bitcoin is the gold of the crypto-economics, then its forks and others, built on the principle of proof of the work of the currency (Proof-of-work, PoW-currencies), may well compete in reserves with precious metals and precious stones. Accordingly, with similar features of turnover, regulation, etc.

It is not a secret that the investing and trading world got its benefits from Bitcoin as well. After boring processes and activities on Forex, many investors jumped into cryptocurrency trading. The latest trend, which is popular among many users and traders, is social trading.

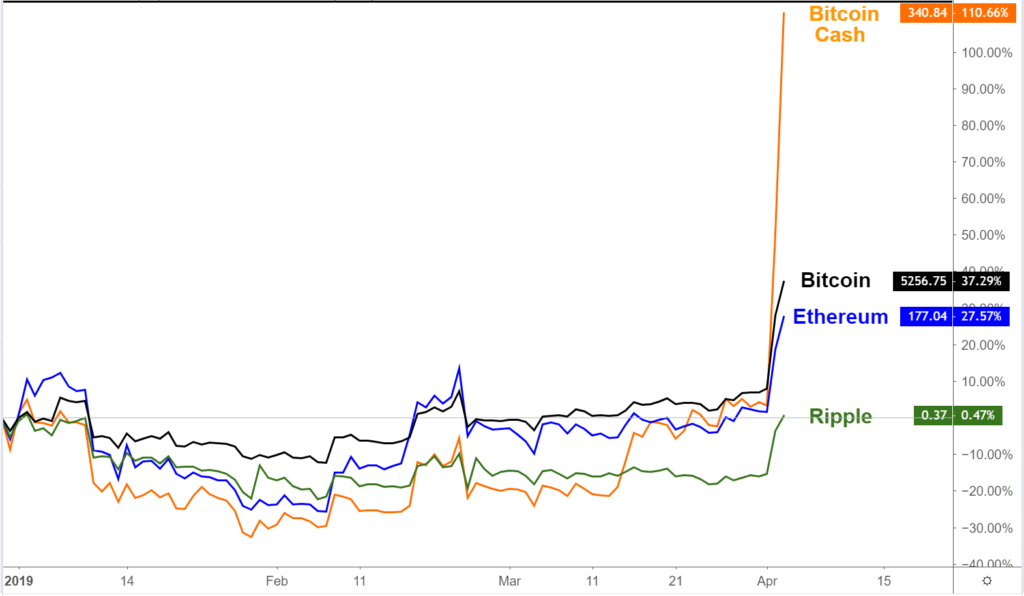

Cryptocurrency social trading is grabbing power nowadays. The latest example is Binaryx.com – which makes and manages the cryptocurrency exchange platform and a single marketplace for each master trader. All of Binaryx’s customers have an excellent chance to exchange, sell, and buy advanced types of digital money, including Bitcoin, Ethereum, and Bitcoin Cash, similarly as to utilize ace traders, to fabricate their pay and trading capacities.

The Power of Decentralization

Digital currencies, the reliability of which is provided by proof of ownership (Proof-of-stake, PoS-currencies), – stand on a par with fiat money as everyday means of payment. They are cheap and straightforward to use, energy-efficient, provide a large number of transactions per second, but they are easier to manipulate and much easier to hack, steal, or fake.

As for crypto assets based on other protection algorithms, including centralized, for them, there is quite a place next to securities, vouchers, certificates, forms of strict reporting, etc. (the same opportunities, but without logistical flaws and human-related risks).

It is quite apparent that the development of cryptocurrencies and other solutions based on blockchain and smart contracts weakens the existing financial system.

Besides, under certain conditions, active support for solutions based on smart contracts and blockchain can even transform into a global idea of the struggle for honesty and justice and will act as an assembly point for people sharing data values.

The Strategy for Digital Economy Development

A natural necessity for the implementation of such a strategy will be a mandatory digital identification of all participants. Blockchain forms the preconditions for an entirely new

level of transparency in both the economic and social spheres. The consequences of which are now not completely clear and, in addition to new opportunities, can introduce risks that are not yet calculated.

Another strategic threat is that crypto technologies are replacing controlling in the form we are used to, when a person performed the functions of controller and guarantor, with something new – control and guarantees from the algorithm.

With all the advantages in the form of reducing transaction costs and the risks associated with participation in the process of a person, there is a depreciation of relations between people, relationships between a person and society.

Conclusion

These and more factors are decisive, and there are no doubts that Bitcoin can (and probably will) create a powerful digital economy in the world.