Cryptocurrencies are big business, hundreds of thousands of people log in to their wallets and visit exchanges to trade every day. But the very same decentralized and deregulated nature that makes crypto coins so attractive to many investors is the very same drawcard that pulls cybercriminals toward cryptocurrency crimes.

In 2019, no less than 12 exchanges were hacked. As reported by Cointelegraph: “$292,665,886 worth of cryptocurrency and 510,000 user logins were stolen from crypto exchanges in 2019. Cryptocurrency exchanges experienced more hacks last year than in 2018, when only nine cryptocurrency exchanges fell victim to security breaches.”

Unfortunately, the threat landscape in 2024 is looking just as concerning from a crypto cybersecurity perspective. Hackers are increasingly upping the ante across multiple sectors during the ongoing COVID-19 crisis and attempting to profiteer from panic. This enhanced threat level has affected the cryptocurrency market too, prompting the FBI to release a warning noting the sector’s susceptibility to cybercrime at the present moment.

To secure your currencies properly, a number of cybersecurity practices should be implemented. Below, in no particular order, are the steps you should take in 2024 to keep your investments and data safe.

1. Choose your exchanges carefully

Because crypto exchanges are largely unregulated, there are no universal security standards. While any exchange worth its salt will always do its utmost to ensure the cybersecurity is top-notch (if for no other reason than to keep clients happy as opposed to any altruism), there are big differences between the well-secured exchanges and those that leave a lot to be desired.

Choose your trading platform carefully, otherwise, you’re punting with more than just a few coins. According to Investopedia, here are a few top picks in 2024 from a cybersecurity perspective:

- Coinbase

- Bisq

- CashApp

- Binance

2. Use VPN encryption

Using a VPN (or Virtual Private Network) whenever you log in to your wallets or the exchange is one of the easiest things you can do to add a strong security protocol to your transactions. VPNs do as the name suggests and create a private network for you to browse on. In the process, they encrypt any data in transmission, meaning your private key will remain private when you enter that data into a site as hackers cannot see your activity, nor decrypt it if they could see.

The trick with a VPN subscription is to choose a quality, paid product, not a free option as these may even compromise your data. To learn more about how they keep you safe online, click here.

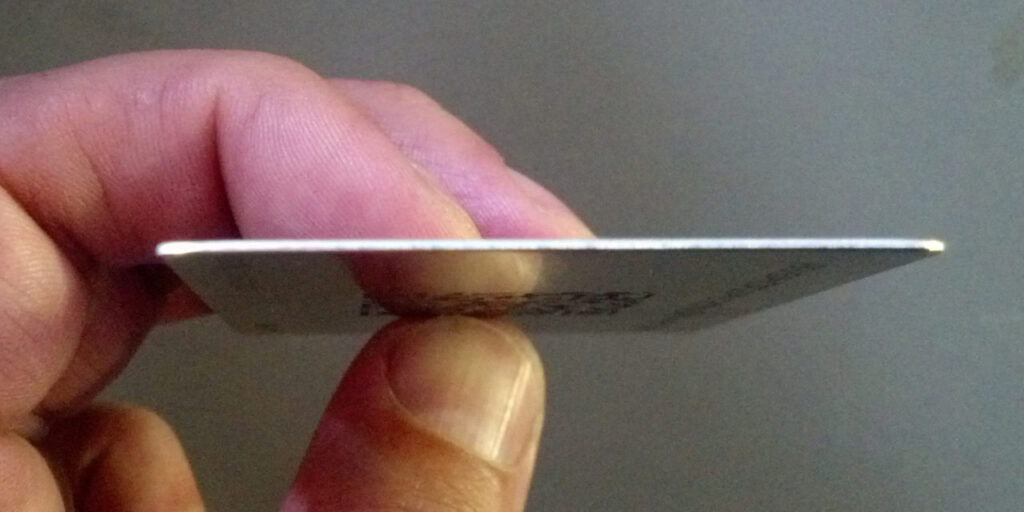

3. Choose cold storage for large sums of cryptocurrency

Let’s say you had around five thousand dollars in traditional cash. Would you feel safe with that money in your wallet, or would you prefer to just keep a few hundred in your pocket and stash the rest in a safe or the bank? You likely chose the first option and it’s the smart thing to do.

The above situation is much like your cryptocurrency options: your “hot” online wallet is the one you use daily to make trades and transactions and you can liken that to the wallet in your pocket. Meanwhile, your “cold” offline storage is just like your safe, harder for criminals to access and hidden away from view.

When you move large sums of cryptocurrency to your cold wallet storage, your investment is much less at risk.

4. Opt for MultiSig wallets

MultiSig is shorthand for multi-signature and it is a method of ensuring a transaction is valid and more secure. Unlike standard crypto wallets, with a MultiSig wallet, you need at least two private keys to complete and authorize a transaction. You can think of it somewhat like a door that has two separate locks.

With MultiSig you have an added layer of protection because if one key is compromised, threat actors cannot use it alone to enact any currency theft as he or she would need both keys. You can set up MultiSig wallets with two keys or even more. The latter option is helpful if you’re investing with others.

5. Avoid public wifi like it’s COVID-19

The risks of public wifi networks have been relayed to users for many years now, but despite the inherent threats, millions of people connect to free open networks every day, leaving their device and their data at risk of attack.

One simple rule to remember with cryptocurrencies and public wifi is that you should never log in to your wallet or exchange while you’re on an unsecured network. We can extend that advice outside a crypto perspective too and note that public wifi should be avoided no matter what you’re doing online. In fact, think of it like COVID-19 and avoid it like, well, the plague.

6. Use 2FA on all your crypto accounts

Much like the MultiSig authentication process we covered above, two-factor authentication is a way to ensure your accounts are more secure by spreading the log-in procedure over multiple steps.

Use 2FA for all your crypto-related accounts, such as when you log in to the exchange. It’s not a bad idea to have multi-factor logins as standard on all your non-crypto accounts either. Just be aware that choosing text messages as your secondary authentication method carries its own set of risks should your phone be lost or stolen.

7. Be aware of current crypto scams

Crypto scams are rife on the web, in email inboxes, and on social media. From urgent ICO offerings to “helpful” tips about an up and coming coin, the level of misinformation and threat is astounding in its sheer volume.

To sort the wheat from the chaff when it comes to crypto tips and offerings, it helps to have a basic understanding of the threat landscape. Additionally, look out for offers that seem too good to be true, as they usually are.

8. Keep your successes to yourself

Let’s go back to the wallet full of five thousand in cash. You wouldn’t stand on a busy street corner in the city and declare for all to hear that your pocket is stuffed with cash. That is inviting trouble. And it’s the same with any cryptocurrency wins or windfalls you have, keep it to yourself or you may find yourself surrounded by threats of the digital kind.